China´s second-largest property developer, Evergrande, is in the news for its financial difficulties. Despite most people having never heard of the company a week ago, there is a broad consensus that its eventual default will bring pandemonium to the markets.

Analogies to the default of Lehman Brothers and the collapse of the global financial system are convenient, but difficult to maintain. On the one hand, Lehman was a private company in a market-based economy. On the other hand, Evergrande is centred in a socialist country that has backed real-estate as a major driver of its economic miracle.

The Chinese government could paper over all of Evergrande´s $300 billion of liabilities and still run a deficit a third smaller than the United States ran last year. And that´s the worst case scenario – that all of the liabilities need to be covered. In reality and as we´ll see, there are still assets in the group, albeit fewer than investors thought just a few short years ago.

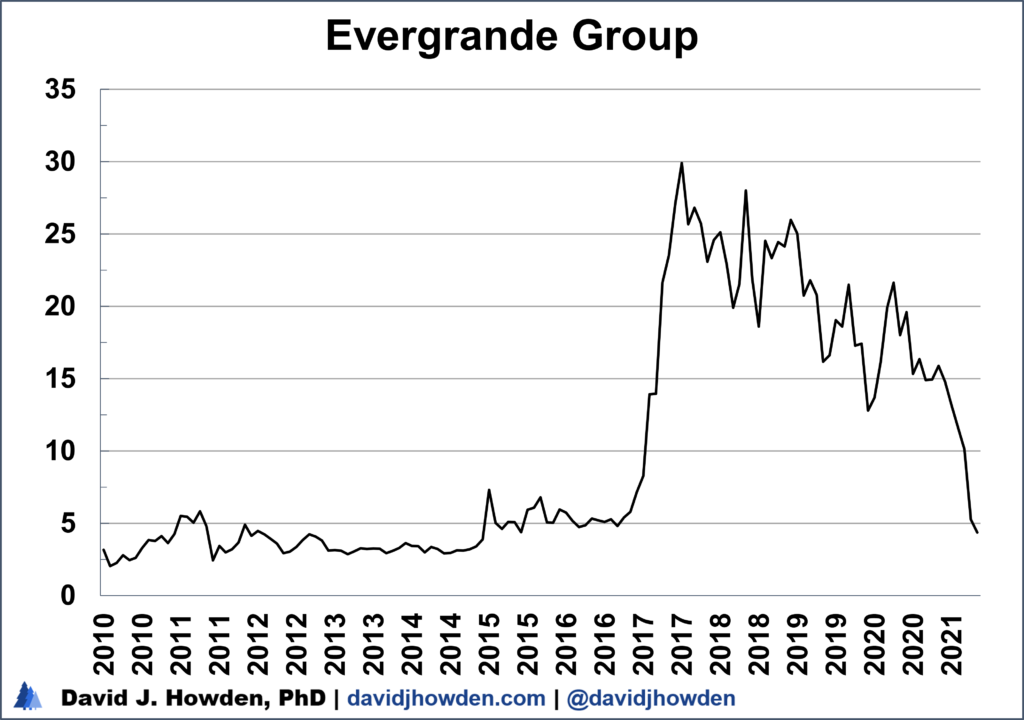

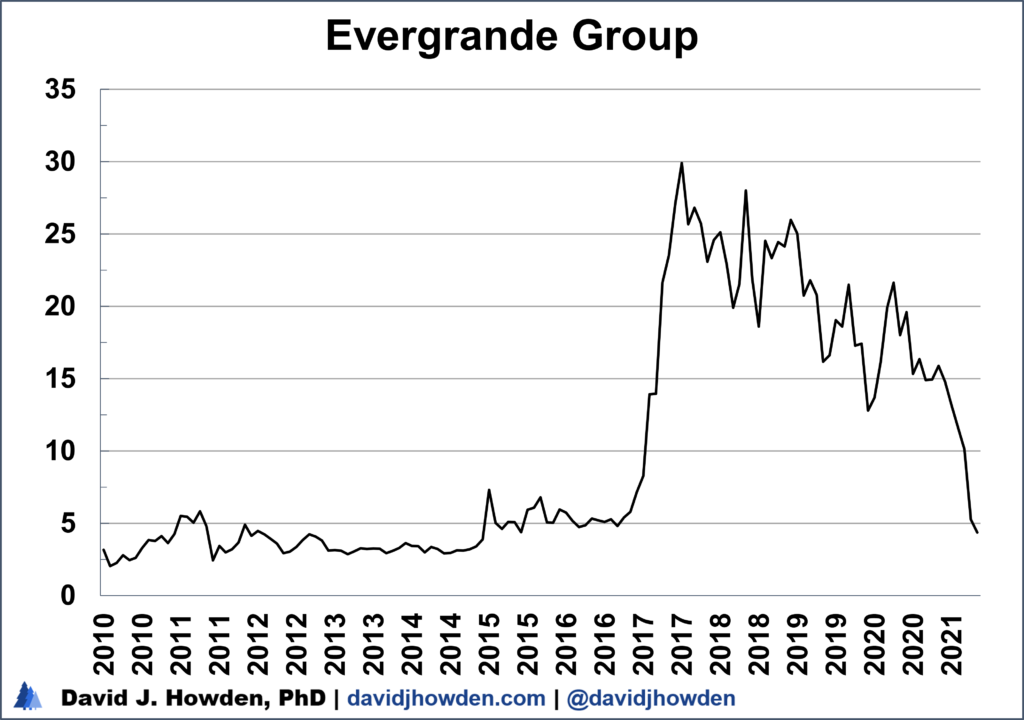

First, let´s address whether Evergrande´s financial difficulties are a shock to the market. That´s the prevailing sentiment at the moment, but it´s pretty difficult to maintain if one just looks at the company´s stock price. After peaking in October 2017, the stock price has made a fairly orderly descent to its current level around $2 a share.

That´s a 94% decline in the value of the company over the course of four years. Not exactly an overnight collapse. It´s pretty hard to believe that the market is being caught off guard by the news of its financial difficulties when the share price has been dropping for years.

Nor are real-estate problems especially unknown in the country. As far back as 2010 the mainstream press has been writing about China´s ghost cities. Evergrande is one of the largest developers of these ghost cities, but investors have known about this for over a decade. Strike two for the markets being “shocked” by the news of the company´s collapse.

A company´s stock price is a function of its earnings, some discount factor and the rate at which the market expects the earnings to change in the future. Of these factors, the expected earnings growth rate is the most difficult to estimate while the other two are actually known pieces of data. We know what the company´s earnings are, and we can get the rate of return by looking at comparable investments (bonds, for example).

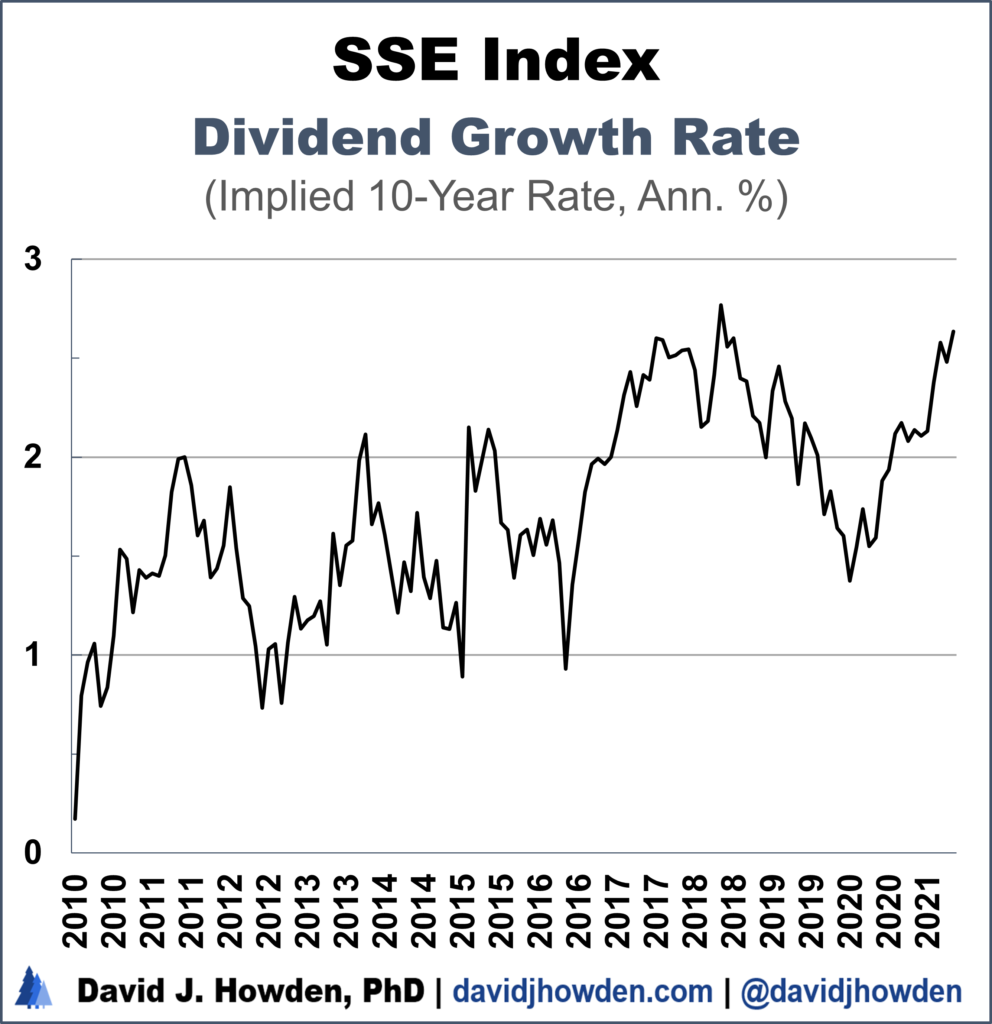

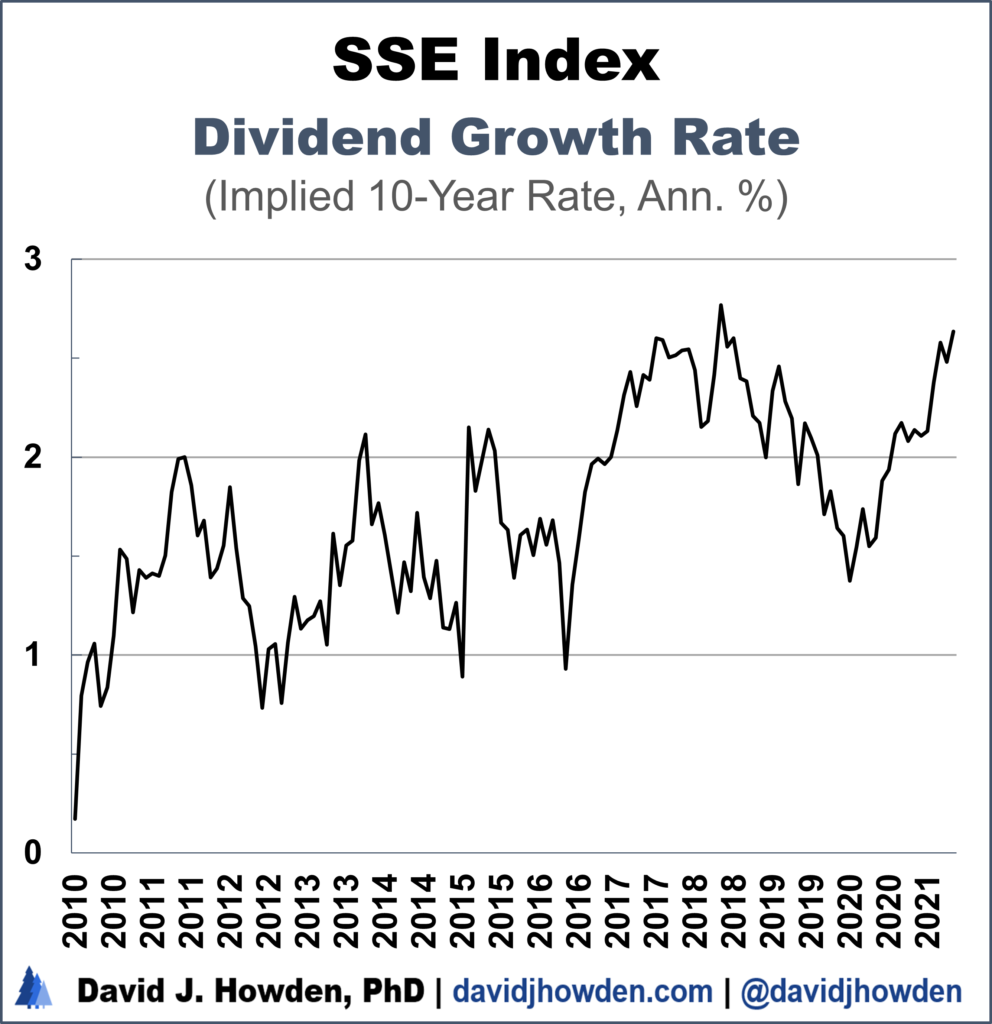

In my Almanac of Global Equities: 2021-31 I estimate what the expected growth rate is for over forty markets from around the world. It´s not perfect, but in the chart below we can get a feel for the rate at which investors in China believe dividends (or earnings, which are tightly linked to dividends) will grow on the SSE Index, the country´s premier stock index (akin to the S&P 500 but for mainland China).

Right now Chinese investors expect earnings on Chinese companies to increase by 2.6% annually over the coming decade.

If we have a stock´s price, and we have an expected growth rate of its earnings, we can compute its dividend payout. This dividend payout is useful to us at this juncture because it lets us see how much the market has discounted the value of Chinese real estate over the past few years. Since Evergrande is primarily a property developer, it´s earnings are linked explicitly to the Chinese real-estate sector. In a way one can say that what is good for Evergrande is good for the real-estate portion of the Chinese economy, though the reverse of that statement is probably more appropriate these days.

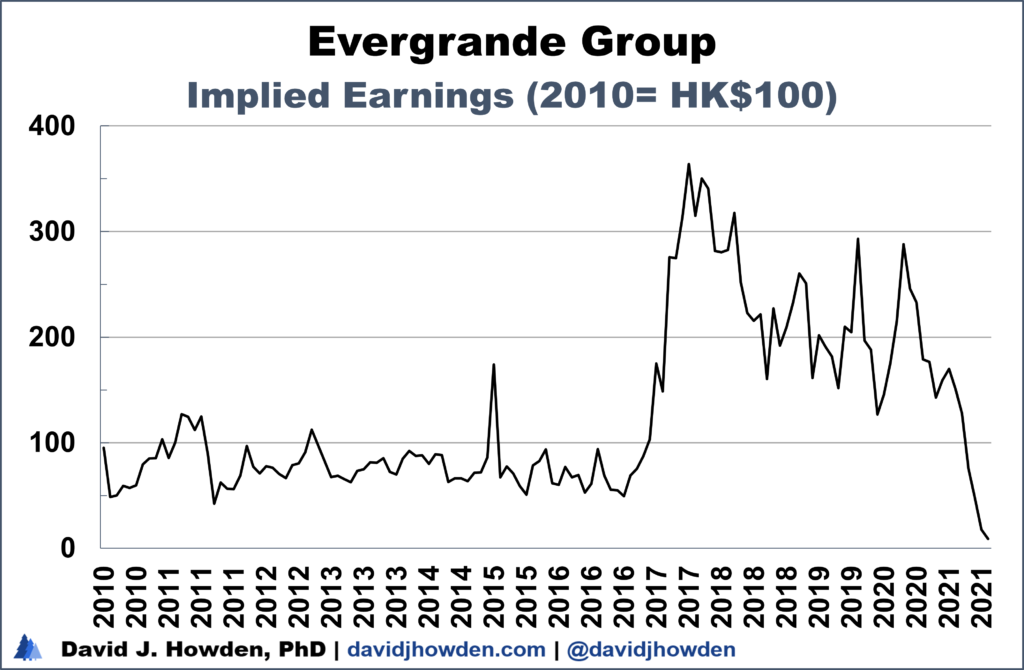

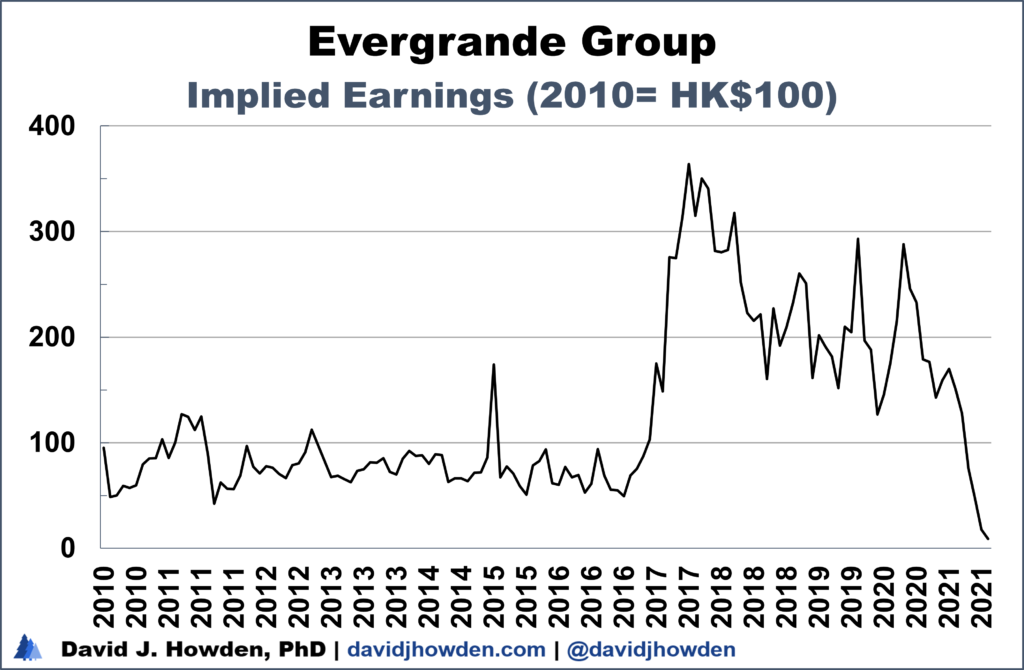

In the chart below we can see the earnings (based on dividends) that the stock market has priced into Evergrande shares. I´ve normalized it to take a value of HK$100 in 2010, to make it easier to interpret. In any case, we´re not interested in the absolute level but in its change over time. (Evergrande is listed in Hong Kong, and it´s share price is listed in terms of the Hong Kong dollar. In any case, since both the Hong Kong dollar and Chinese renminbi are fixed to the US dollar, it doesn´t matter which currency we use for the analysis.)

Here we can see the real real-estate boom in China. The boom was really contained between November 2016 and September 2017, when the imputed earnings peaked. Over these eleven short months, the market increased its valuation of the earnings produced by Chinese real-estate by 640%! Now that´s a BOOM.

But look at what has happened since. In three stages the market has knocked down the value of Chinese real estate.

The first state, from the late 2017 peak to September 2018 slashed 55% off the value of the earnings expected to be produced by Chinese real estate (or at least, by the real estate developed by Evergrande). This was followed by a period of consolidation until June 2020 as the market tried to suss out what was a more realistic expectation of the value of these earnings. And now we´re in the final stage of this washout where the value of property earnings has continued to fall.

From its 2017 peak, the market has cut its expectation of Evergrande´s earnings by 97.5%. That´s a lot, but it happened over four years. It´s not like the market is being caught off guard by a new development. And more than half of that loss has been realized since 2018.

So now, a quick stocktaking. Evergrande´s stock price has suffered a large but orderly decline of 94% over the past four years. The earnings the market expects the company to earn have been slashed by nearly 98% over the same period, but over half of that was from three years ago. In short, I don´t know what is new about this information that the market didn´t already know that will shock the world economy into crisis.

I tweeted as much recently. The company has already lost 94% of its value, or in other words, it is already 94% of the way to bankruptcy. What difference do you think losing the last 6% is going to make?

A final note. Some commentators seem to be aware that the equity holders are already wiped out, but if there are no assets left then bondholders will also be wiped out. The American investment management company, Blackrock, is the largest holder of Evergrande debt. If anyone is going to be hurt by its default, it´s Blackrock.

Over the past month Blackrock´s stock has taken an 11% hit. That´s a not insignificant short-term hit, but it´s hardly earth shattering. The S&P 500 took a 5% whack, so it is not as if Blackrock´s loss is much greater than the loss imposed on the general market, most of which has absolutely no exposure to Evergrande.

In the news cycle´s constant bid to make a crisis out of everything, we can chalk Evergrande´s misfortunes up to another attempt to make a mountain out of a molehill. The company is done, that much is true. But it´s not exactly a surprise to the market, and it is not a chaotic shock to the global financial system.